Analyzing risk at the same time as returns

Barra Real Time Analytics provides a convenient, easy way to access the Barra Factor Portfolios - baskets of both long and short positions that have a unit exposure to a given style or industry factor, and zero exposure to all the other factors.

By decomposing the risk and returns of your portfolios or an index in real time, you can analyze:

By decomposing the risk and returns of your portfolios or an index in real time, you can analyze:

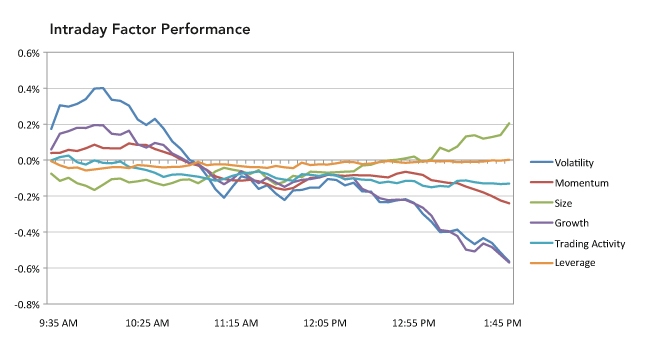

- Which factors are moving the markets today

- Whether an event is a broad market event, or limited to specific styles or industries

- Whether it is similar to a previous event, such as a quant meltdown, or a credit crunch

- How volatile each factor is during the trading day

Barra Real Time Analytics can be used across the investment process in a variety of real time scenarios, such as:

- A small cap portfolio manager wants to understand how his exposure to the volatility factor is affecting his P&L at this moment

- A proprietary trader wants to take an active tilt to the momentum factor because momentum seems to be performing well at that moment

- A deep value manager wants to reduce the leverage exposure in a financial stocks portfolio given a market event

- A passive manager wants to decompose the returns of the MSCI USA Index by styles or industry factors in order to gain more clarity on what is moving the markets at a specific moment