BarraOne includes an integrated performance attribution module, allowing users to perform multi-asset class risk and performance analysis on a single platform. Utilizing established Barra Analytics, the BarraOne Performance Attribution module supports industry standard Allocation-Selection attribution as well as the Barra proprietary fixed income attribution methodology.

Key Benefits

- Load once, work twice. Portfolios can be loaded onto the BarraOne platform for both risk analysis and performance attribution, significantly reducing data management and reconciliation time.

- Leverage BarraOne's automation capabilities to streamline portfolio loading, processing and reporting to create consistent performance attribution reports for investment committees, portfolio managers and fund marketing. Reports tasks can be easily scheduled and batched.

- Select the attribution framework that suits your investment process. BarraOne offers a highly flexible Allocation-Selection attribution methodology that can be applied to portfolios of any asset class, including balanced and multi-asset class funds.

- BarraOne provides a large universe of popular equity and fixed income benchmarks pre-loaded into the platform and ready to be used. A wide range of market data is also available for asset valuation.

Examples

Click on the images to see in more detail.

- Monthly Snapshot of Attribution Summary

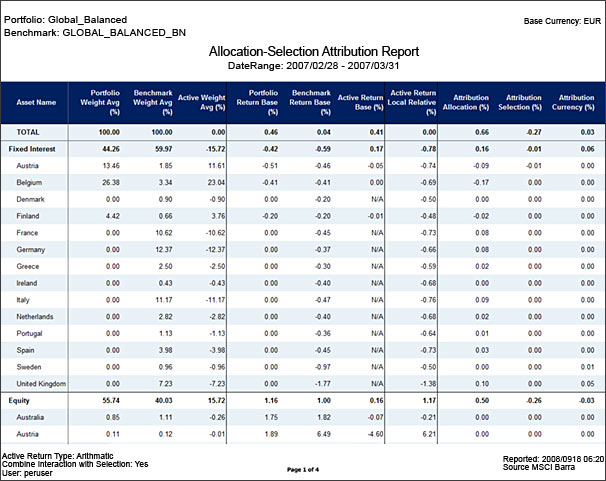

- Example of an Allocation-Selection Attribution Report

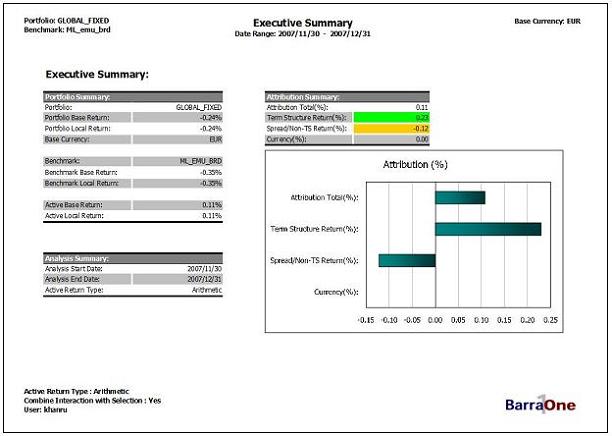

- Example of an Executive Summary Report Monthly Snapshot of Attribution Summary

Example of an Allocation-Selection Attribution Report

Example of an Executive Summary Report