BarraOne 3.4

BarraOne 3.4 adds a number of new capabilities that provide users with tools to help manage portfolio risk over long and short horizons.

Highlights of this release include:

A New Barra Integrated Model Designed for Short-Horizon Risk Forecasts

The new Barra Integrated Model (BIM) Daily is designed for short-horizon forecasts. This model provides a more responsive risk forecast at short horizons (1-10 days) to support users' tactical portfolio allocation decisions and shorter maturity strategies.

Multiple-Horizon Model Support for Common Factor Risk and Correlated Stress Tests

BarraOne 3.4 can now support multiple-horizon models for forecasting common factor risk and computing correlated stress tests. The flexibility to tune risk model parameters enables users to define multiple-horizon models that are consistent with their view of market and volatility environments. BIM Daily is used for 1-10 day horizons, while the existing long-horizon BIM is used for horizons of greater than 10 days.

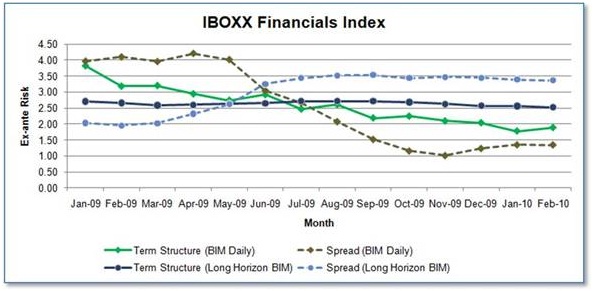

Figure 1: BIM Daily shows that the spread risk became larger than the interest rate risk for investment-grade bonds during the volatile period of early 2009. The model reacted quickly to the regime change and reverted around July 2009.

Power Value at Risk

Reflecting new advances in risk methodologies, Power VaR in BarraOne 3.4 incorporates information about empirical fat-tails of factor returns to provide users with a more precise forecast of left-tail risk. Users can select from multiple, non-normal distributions in Monte Carlo VaR simulations, including distributions based on empirical factor returns. In addition, Power VaR introduces several new, adjustable simulation parameters, including marginal distributions, copulas, and degrees of freedom.

Figure 2: Power VaR empirical data, where possible, to construct marginal distributions of individual factors. Incorporates information about fat-tails by using the entire history of available factor returns.

Historical VaR Decomposition

Users can now isolate the sources of simulation risk in a position or a portfolio due to changes in specific market conditions, such as equity markets, interest rates, credit spreads, or equity volatilities.

Bloomberg Link

The new Bloomberg Link enables authorized users to load asset-level data from their Bloomberg Data License account directly into their BarraOne user account via the BarraOne Developer's Toolkit. Data that can be imported from Bloomberg into BarraOne include prices and terms and conditions for cash bonds, listed equity options, and listed currency options.

Asset Coverage Enhancements

BarraOne 3.4 enables users to import implied volatility surfaces for modeling options on equities, currencies, and commodities. BarraOne now also supports full revaluation in Monte Carlo VaR for instruments with arbitrary payoff structures, such as equity-linked notes, interest-rate "snowballs," exotic basket options, and complex trigger options.